Briefing Paper #376

Executive summary

The U.S. steel industry is facing its worst import crisis in more than a decade. In the aftermath of the Great Recession, steelmakers in other countries, backed by aggressive government support, continued to add production capacity as demand stagnated. The open and large U.S. market became the prime target for the massive excess supply stemming from this excess capacity, and, since 2011, U.S. steel imports have surged and import unit values have plummeted.

- Global excess steel capacity is now over half a billion metric tons, more than twice the volume of excess capacity in the last steel import crisis that followed the Asian financial crisis more than a decade ago. While China accounts for more than a third of global excess capacity, there is also significant overcapacity in South Korea, India, and elsewhere. With more additions planned overseas and a continued slow recovery in demand, the excess capacity problem is not projected to be resolved any time soon.

- Excess capacity means that steel production facilities have the capacity to produce much more steel than the market demands. High fixed costs, capital intensity, and the large scale of steelmaking encourages state-backed producers with excess capacity to maintain production in excess of domestic demand, and export the surplus at below-market rates.

- The glut of exports from global excess steel supply is targeted in particular at the U.S. market. U.S. steel imports increased from 28.5 million net tons in 2011 to 32.0 million net tons in 2013, an increase of 12.3 percent. Imports have increased not only in absolute terms, but also relative to domestic production and consumption, seizing more of the U.S. market and thwarting the domestic industry’s efforts to recover from the Great Recession.

- U.S. steel imports surged even more sharply in the first two months of 2014, hitting 6.4 million net tons, an increase of 24.5 percent over the same period in 2013. Domestic shipments declined 0.9 percent over the same period. Consequently, the import share of the domestic market increased 4.5 percentage points in January–February 2014 (an increase of 18.5 percent over the same period in 2013).

- Evidence that imported steel prices are falling, and falling unfairly, can be found in the declining sales price of imports (now underselling comparable domestic products) and the rapid growth in the number of unfair trade complaints filed in the past year. The average unit value of imported steel declined $259 per ton (23.1 percent) between 2011 and January–February 2014. U.S. steel producers filed 40 antidumping and countervailing duty petitions in 2013 and the first two months of 2014, the largest volume of trade cases in steel since 2001.

Surging imports of unfairly traded steel are threatening U.S. steel production, which supports more than a half million U.S. jobs across every state of the nation. The import surge has depressed domestic steel production and revenues, leading to sharp declines in net income in the U.S. steel industry over the past two years (2012–2013), layoffs for thousands of workers, and reduced wages for many more.

- While U.S. steel output has begun to recover from the depths of the Great Recession, domestic producers have experienced declining shipments since 2013, and sharply declining revenues since 2012. As a result, the U.S. steel industry had net losses of $388 million in 2012 and $1.2 billion in 2013, and it has now posted net losses in four of the past five years. A large, capital-intensive industry cannot long survive in its present form when subject to such chronic financial losses.

- As the domestic industry has struggled with growing unfair import competition, thousands of steel workers have lost their jobs. Since the beginning of 2012, an estimated 4,184 steel workers in eight states have been certified for Trade Adjustment Assistance because imports or shifts in production contributed to their job loss. More layoffs have been announced in recent months. Nearly 1,000 steel jobs have been lost due to surging imports in the first three months of 2014.

- U.S. steel production supported 583,600 jobs in 2012, including 123,400 direct jobs in steel production; 255,500 of the jobs supported were in manufacturing (including direct jobs in the steel industry), accounting for 43.8 percent of all jobs supported by the industry. These jobs are at risk if surging imports of unfairly traded steel are allowed to displace domestic steel production.

- The top 10 states, ranked by total number of jobs at risk from displaced domestic steel production, are Texas (59,800 jobs supported), California (52,300 jobs), Pennsylvania (35,300 jobs), Ohio (33,900 jobs), Illinois (28,400 jobs), Indiana (26,000 jobs), New York (25,100 jobs), Florida (23,200 jobs), Michigan (20,100 jobs), and Wisconsin (15,700 jobs).

These 583,600 steel-related jobs are at risk if the U.S. does not fully and effectively enforce its trade remedy laws, which have historically been vital to the survival of the U.S. steel industry. Trade remedies enabled the U.S. steel industry to survive the last import crisis, and their effective enforcement is equally critical today.

- The excess capacity plaguing the steel industry stems largely from massive government support for, and direct government involvement in, the steel industry in other countries. In 2011, half of the world’s 46 top steel companies were state-owned, and these state-owned companies accounted for 38 percent of global production. These governments view their steel industries as strategic (i.e., important to grow regardless of profit), and thus governments provide a wide array of subsidies to their steel industries, including grants, tax breaks, subsidized loans and debt forgiveness, the provision of inputs at below market rates, direct equity infusions, and more. These factors lead to “uneconomic additions to capacity”—increases in capacity that don’t make economic sense because they are not driven by demand.

- U.S. imports of unfairly traded steel products are increasing as countries such as China and others sell dumped and subsidized “upstream” (basic) steel products to other countries, which use these inputs in the “downstream” (finished) products, like pipes, that they sell to the U.S. China and Korea accounted for more than three-fourths (77.9 percent) of the growth in global steel exports between 2003 and 2012. Imports of Chinese steel by South Korea and Japan rose sharply between 2009 and 2012; Korea and Japan, in turn, are themselves major exporters to the U.S.

- Aggressive government support, coupled with the industry’s capital-intensive nature (i.e., its difficulty ramping down production to handle drops in demand) leads to the kinds of trade distortions (overcapacity, export surges) now threatening the U.S. market. The last time this happened, in the early 2000s following the 1998 Asian financial crisis, trade remedies served as a vital line of defense. Trade remedies have provided significant benefits for the domestic industry and its workers, including resurgent shipments and sales revenue, improved operating performance, retained jobs, and the ability to make needed capital investments. In cases where relief is denied, the costs have been just as great, in some cases forcing the industry to endure additional years of injury before finally obtaining needed relief, or, worse, going out of business.

- Trade remedies are once again critical to the industry’s survival. U.S. steel producers filed 40 antidumping and countervailing duty petitions in 2013 and the first two months of 2014, covering nine products from 18 different countries. Determinations in these cases will be made later this year and in early 2015. Over 14,000 workers, producing the affected steel products in 92 locations across 29 states, depend on effective relief in these cases alone.

In short, trade remedies have been critical to the survival of the steel industry and the more than half-million workers who depend on that industry, particularly when the industry faces the kind of crisis that threatens it today. Policymakers should ensure that trade remedies are effectively enforced, that enforcement discretion is exercised consistent with the remedial goals of the statute (the Tariff Act of 1930, as amended), and that the remedies do in fact fully redress the unfair trade practices distorting the U.S. market. This requires that policymakers review areas in which changes in practice, methodologies, regulations, and the law may be needed to ensure that the steel industry and its workers can continue to rely on these vital tools.

I. Steel’s import crisis

The U.S. steel industry is in the midst of an import crisis resulting from a confluence of forces including the rapidly growing surplus in global steel capacity and a surge in unfair import competition. This section examines the dimensions of steel’s import crisis. Later sections examine the importance of steel production to the U.S. economy, review root causes of the crisis, present policy recommendations, and asses the importance of effective enforcement and enhancement of trade remedy laws.

A. Global overcapacity threatens U.S. steel industry viability

For decades, the global steel industry has been plagued by uneconomic production capacity additions which lead to market-distorting surges of exports by other countries in times of economic distress.

1. Global overcapacity is growing by any measure

Capacity is a measure of how much steel existing equipment could produce, while excess capacity is the difference between capacity and actual production. Prior to the mid-1970s, increases in global steel capacity were commensurate with increases in consumption; starting in 1974, however, a combination of foreign-government intervention in the steel industry and stagnant growth in consumption led to increases in capacity that outpaced increases in consumption (Howell et al. 1988). Since the mid-1970s, the U.S. steel industry has continued to face crisis after crisis as foreign-government-supported producers in this capital-intensive industry have used predatory trade practices, rather than rational restructuring and consolidation, to weather the storm when demand for steel collapses.

The U.S. steel industry and its workers face another such crisis today. In the aftermath of the global financial crisis in 2008, when demand plummeted, the global steel industry continued to add capacity. The capacity additions did not make rational economic sense in the devastated global marketplace, but many were made with the support and involvement of home-country governments eager to grow their steel industries regardless of the cost.

The huge growth in excess global production capacity that occurred in 2008 and 2009 continues to threaten the steel industry five years later. One measure of excess capacity is the capacity utilization rate, which shows how much of total production capacity is engaged in actual production. As Figure A shows, when the 2008 financial crisis decimated demand, capacity utilization (right axis) in the global steel industry dipped below 80 percent for the first time since 2000. In an industry where a capacity utilization rate of around 92 percent is considered “healthy,” the low 79 percent rate reached in 2008 was reminiscent of the 1980s and 1990s, when capacity utilization remained below 80 percent (Boston Consulting Group 2002; Howell et al. 1988).

Global crude steel production, capacity, and capacity utilization, 2000–2013

| Year | Production | Excess capacity | Capacity utilization rate (%) |

|---|---|---|---|

| 2000 | 850.156 | 228.644 | 78.81% |

| 2001 | 852.173 | 209.827 | 80.24% |

| 2002 | 905.155 | 221.745 | 80.32% |

| 2003 | 971.016 | 198.984 | 82.99% |

| 2004 | 1,062.541 | 182.459 | 85.34% |

| 2005 | 1,147.772 | 227.328 | 83.47% |

| 2006 | 1,250.473 | 202.527 | 86.06% |

| 2007 | 1,348.122 | 234.878 | 85.16% |

| 2008 | 1,342.625 | 358.275 | 78.94% |

| 2009 | 1,237.044 | 578.956 | 68.12% |

| 2010 | 1,432.750 | 484.250 | 74.74% |

| 2011 | 1,536.988 | 426.312 | 78.29% |

| 2012 | 1,545.011 | 499.689 | 75.56% |

| 2013 | 1,582.493 | 517.107 | 75.37% |

Sources: American Iron and Steel Institute et al. (2010); De Carvalho and Daniel (2012); World Steel Association (various years, 2013a)

The situation deteriorated even further in 2009, when global capacity utilization dropped to just 68 percent, and, as Figure A shows, it has remained below 80 percent since that time, with increases in 2010 and 2011 followed by declines in 2012 and 2013.

The excess capacity currently burdening the market is also large on an absolute basis. After declining in 2010 and 2011 from the peak reached in 2009, the volume of excess capacity grew in 2012 and 2013, as Figure B shows. Global excess production capacity is now over half a billion metric tons. This is more than twice the excess capacity that burdened the global steel market in the early 2000s in the wake of the 1998 Asian financial crisis.

Excess global crude steel capacity, 2000–2013

| Year | Millions of metric tons |

|---|---|

| 2000 | 228.644 |

| 2001 | 209.827 |

| 2002 | 221.745 |

| 2003 | 198.984 |

| 2004 | 182.459 |

| 2005 | 227.328 |

| 2006 | 202.527 |

| 2007 | 234.878 |

| 2008 | 358.275 |

| 2009 | 578.956 |

| 2010 | 484.250 |

| 2011 | 426.312 |

| 2012 | 499.689 |

| 2013 | 517.107 |

Sources: American Iron and Steel Institute et al. (2010); De Carvalho and Daniel (2012); World Steel Association (various years, 2013a)

The volume of excess capacity is so massive that there is little prospect the gap can be narrowed any time soon. Even if capacity were to remain flat, it is estimated that it would take until 2017 to 2019 for global consumption to catch up (De Carvalho 2012). But it is highly unlikely that capacity will remain flat. Instead, countries are continuing to invest in new capacity, further threatening the viability of the global steel industry. In far too many cases, these capacity additions are motivated by government support rather than economic fundamentals.

The persistently high overcapacity since 2008 has sparked serious concerns in the Organization for Economic Cooperation and Development (OECD) Steel Committee. On December 6, 2013, the chairman of the committee noted excess capacity had reached “very high levels” (Nezu 2013). The statement continued:

The financial performance of the industry could be viewed as worse now than during the crisis of the late 1990s. Recent trends in key financial indicators, such as profitability or indebtedness, raise serious concerns and suggest that the global industry is in a very difficult economic and financial situation … High levels of excess capacity cloud prospects for the industry’s profitability. As global steel demand is expected to grow slowly in the coming years and with many new investment projects coming on stream, excess capacity will continue to weigh on the operating profitability of the global steel industry. (Nezu 2013)

Other participants agreed that excess capacity is “one of the biggest challenges facing the steel industry” (Silva, Daniel, and De Carvalho 2013).

Large and growing excess capacity has significant impacts on the industry’s viability, and declines in the industry’s capacity utilization rate are tightly correlated with declining operating income (De Carvalho 2013). The OECD reports that the growth in capacity since the 2008 financial crisis has outpaced the growth seen in the wake of the 1998 Asian financial crisis; as a result, the steel industry’s financial performance from 2008 to 2012 was worse than it was between 1998 and 2001, in the wake of the 1998 Asian financial crisis (Silva, Daniel, and De Carvalho 2013). The industry is also burdened with large debt obligations and high costs (McKinsey 2013, World Steel Dynamics 2013). As global capacity utilization is expected to remain 75 percent or less in the coming years, the OECD predicts that operating profitability will likely remain at current unsustainable levels for a number of years (Silva, Daniel, and De Carvalho 2013).

Much of this excess capacity is located in China. By the end of 2012, crude steelmaking capacity in China had reached one billion metric tons, and China’s capacity utilization rate was just 72 percent (MOFCOM 2013). By some estimates, China accounted for more than a third of the world’s total excess steel capacity in 2012 (Han 2013). A 2013 report on the global steel industry, noting that excess capacity is the most significant issue for the sector, also explained that “the overproduction versus domestic demand from China is likely to persist as the country’s steel mills are required to maintain employment and GDP targets” (Ernst & Young 2013). The China Iron & Steel Association estimates that capacity will increase by another three percent in 2014 alone (Song 2014).

Units of mass used in this report

This report utilizes data from the American Iron and Steel Institute (AISI 2013) and various international sources. U.S. steel data are presented here in millions of net tons (MNTs). The net (or short) ton equals 2,000 pounds. International data are presented in metric tons (MTs), the measure used in most international reports. One MT is equal to 1,000 kg, or 1.102311 net tons. A common unit of measure is one million metric tons (MMT). The long (or gross) ton is used in the imperial system (in the U.K. and some other English-speaking countries) and equals 2,240 pounds. The long ton is not used here.

These additions will build upon the remarkable rise of China’s steel industry in recent decades. As discussed in more detail in Section III.A, this astronomical growth has been fueled by explicit government policies promoting China’s steel industry and massive government investment in the steel sector in China.

2. Excess capacity leads to overproduction and surges of exports

As Section III explains in more detail, the steel industry’s capital intensity, combined with state support for foreign steel producers, leads to excess capacity and production. This trend can be seen in recent data. Global steel production grew from 716 million metric tons in 1980 to an estimated 1,582 million metric tons in 2013 (World Steel Association various years). Most regions maintained relatively stable production during this time. As Figure C demonstrates, the growth in production can be attributed almost entirely to the exponential increase in Asia starting in the 1990s.

Crude steel production by region, 1980–2013

| Year | European Union (27) | North America | Asia | Rest of world |

|---|---|---|---|---|

| 1980 | 208.027 | 124.804 | 172.996 | 210.574 |

| 1981 | 200.913 | 132.404 | 164.367 | 209.545 |

| 1982 | 185.056 | 87.121 | 167.643 | 205.735 |

| 1983 | 184.805 | 97.193 | 168.718 | 213.031 |

| 1984 | 198.957 | 106.812 | 181.849 | 222.628 |

| 1985 | 199.027 | 102.779 | 188.022 | 229.075 |

| 1986 | 190.492 | 96.218 | 189.261 | 238.009 |

| 1987 | 191.215 | 104.174 | 198.114 | 242.000 |

| 1988 | 203.011 | 114.105 | 214.580 | 248.406 |

| 1989 | 203.687 | 112.920 | 223.398 | 245.934 |

| 1990 | 191.820 | 111.447 | 233.774 | 233.388 |

| 1991 | 181.823 | 101.391 | 242.718 | 207.660 |

| 1992 | 173.837 | 107.980 | 242.986 | 194.994 |

| 1993 | 174.611 | 113.403 | 259.892 | 179.663 |

| 1994 | 184.829 | 116.187 | 260.993 | 163.097 |

| 1995 | 190.661 | 122.726 | 274.933 | 164.867 |

| 1996 | 178.125 | 124.476 | 283.413 | 164.976 |

| 1997 | 193.866 | 129.489 | 303.650 | 172.849 |

| 1998 | 191.057 | 129.945 | 293.452 | 164.076 |

| 1999 | 182.185 | 130.044 | 304.738 | 173.243 |

| 2000 | 193.387 | 135.374 | 329.380 | 192.015 |

| 2001 | 187.452 | 119.857 | 350.419 | 194.445 |

| 2002 | 188.246 | 122.949 | 390.677 | 203.283 |

| 2003 | 192.511 | 126.161 | 437.699 | 214.645 |

| 2004 | 202.523 | 134.021 | 497.545 | 228.452 |

| 2005 | 195.608 | 127.631 | 593.153 | 231.380 |

| 2006 | 207.306 | 131.789 | 669.665 | 241.713 |

| 2007 | 210.185 | 132.618 | 751.862 | 253.457 |

| 2008 | 198.616 | 124.494 | 777.986 | 241.529 |

| 2009 | 139.393 | 82.578 | 806.967 | 208.106 |

| 2010 | 172.816 | 111.562 | 911.973 | 236.399 |

| 2011 | 177.717 | 188.675 | 988.537 | 182.059 |

| 2012 | 168.592 | 121.608 | 1,005.765 | 249.046 |

| 2013 | 165.601 | 119.251 | 1,059.151 | 238.490 |

Sources: World Steel Association (various years, 2013a, 2013b)

While a number of Asian countries have increased their steel production in the past 30 years, the vast majority of the increase in production is attributable to China, as can be seen in Figure D. China alone increased its production from 37.1 million metric tons in 1980 to 779.0 million metric tons in 2013, and China’s production grew from 5 percent of global production to 49 percent of global production during that period. In contrast, production in countries that had accounted for the largest proportion of global steel production in 1980 stayed flat or experienced declines. From 1980 to 2013, production in the United States decreased from 101.5 million metric tons to 87.0 million metric tons, European production fell from 208.0 to 165.6 million metric tons, and Japanese production stayed essentially flat at about 111 million metric tons.

Crude steel production by country, 1980–2013

| Year | Rest of world | European Union (27) | United States | Japan | India | South Korea | China |

|---|---|---|---|---|---|---|---|

| 1980 | 240.331 | 208.027 | 101.455 | 111.395 | 9.514 | 8.558 | 37.121 |

| 1981 | 237.905 | 200.913 | 109.613 | 101.676 | 10.765 | 10.753 | 35.604 |

| 1982 | 233.381 | 185.056 | 67.655 | 99.548 | 10.997 | 11.758 | 37.160 |

| 1983 | 242.829 | 184.805 | 76.761 | 97.179 | 10.237 | 11.915 | 40.021 |

| 1984 | 254.706 | 198.957 | 83.939 | 105.586 | 10.549 | 13.034 | 43.475 |

| 1985 | 262.261 | 199.027 | 80.067 | 105.279 | 11.936 | 13.539 | 46.794 |

| 1986 | 272.222 | 190.492 | 74.031 | 98.275 | 12.197 | 14.555 | 52.208 |

| 1987 | 278.716 | 191.215 | 80.876 | 98.513 | 13.121 | 16.782 | 56.280 |

| 1988 | 287.903 | 203.011 | 90.650 | 105.681 | 14.309 | 19.118 | 59.430 |

| 1989 | 287.423 | 203.687 | 88.852 | 107.909 | 14.608 | 21.873 | 61.587 |

| 1990 | 274.106 | 191.820 | 89.726 | 110.339 | 14.963 | 23.125 | 66.350 |

| 1991 | 248.281 | 181.823 | 79.738 | 109.649 | 17.100 | 26.001 | 71.000 |

| 1992 | 236.394 | 173.837 | 84.322 | 98.132 | 18.117 | 28.055 | 80.940 |

| 1993 | 223.801 | 174.611 | 88.793 | 99.623 | 18.155 | 33.026 | 89.560 |

| 1994 | 205.101 | 184.829 | 91.244 | 98.295 | 19.282 | 33.745 | 92.610 |

| 1995 | 211.560 | 190.661 | 95.191 | 101.640 | 22.003 | 36.772 | 95.360 |

| 1996 | 214.636 | 178.125 | 95.535 | 98.801 | 23.753 | 38.903 | 101.237 |

| 1997 | 227.078 | 193.866 | 98.485 | 104.545 | 24.415 | 42.554 | 108.911 |

| 1998 | 217.303 | 191.057 | 98.658 | 93.548 | 23.480 | 39.896 | 114.588 |

| 1999 | 227.114 | 182.185 | 97.427 | 94.192 | 24.296 | 41.042 | 123.954 |

| 2000 | 249.970 | 193.387 | 101.824 | 106.444 | 26.924 | 43.107 | 128.500 |

| 2001 | 248.976 | 187.452 | 90.102 | 102.866 | 27.291 | 43.852 | 151.634 |

| 2002 | 261.123 | 188.246 | 91.587 | 107.746 | 28.814 | 45.390 | 182.249 |

| 2003 | 273.892 | 192.511 | 93.677 | 110.511 | 31.779 | 46.310 | 222.336 |

| 2004 | 294.674 | 202.523 | 99.681 | 112.718 | 32.626 | 47.521 | 272.798 |

| 2005 | 295.406 | 195.608 | 94.897 | 112.471 | 45.780 | 47.820 | 355.790 |

| 2006 | 309.455 | 207.306 | 98.557 | 116.226 | 49.450 | 48.455 | 421.024 |

| 2007 | 324.935 | 210.185 | 98.102 | 120.203 | 53.468 | 51.517 | 489.712 |

| 2008 | 310.165 | 198.616 | 91.350 | 118.739 | 57.791 | 53.625 | 512.339 |

| 2009 | 262.752 | 139.393 | 58.196 | 87.534 | 63.527 | 48.572 | 577.070 |

| 2010 | 303.207 | 172.816 | 80.495 | 109.599 | 68.976 | 58.914 | 638.743 |

| 2011 | 321.314 | 177.717 | 86.398 | 107.601 | 73.471 | 68.519 | 701.968 |

| 2012 | 317.316 | 168.592 | 88.695 | 107.232 | 77.561 | 69.073 | 716.542 |

| 2013 | 293.106 | 165.601 | 86.955 | 110.570 | 81.213 | 66.008 | 779.040 |

Sources: World Steel Association (various years, 2013a, 2013b)

While much of China’s production growth was driven by rising demand in China, that growth has now outstripped demand, making China not only the largest steel producer, but also the largest exporter and a net exporter to the rest of the world. In 2000, China’s steel production was still below its domestic steel usage, with a gap of about 35 million metric tons; by 2012, China was producing 29 million more metric tons than it used domestically (World Steel Association 2013b) which is equal to one-third of total U.S. domestic production. As noted by Ernst & Young (2013), China’s exports have ripple effects around the world, as they are destined for almost every region around the globe, including countries in Asia that are also major exporters.

Though China is by far the biggest player in the global steel industry, it is not alone in its growth and continued investments in new capacity and thus, production. Figure D shows that significant increases in production from 1980 to 2013 were also made by India (from 9.5 million metric tons to 81.2 million metric tons) and South Korea (from 8.6 million metric tons to 66.0 million metric tons).

India has significant overcapacity, and with large additions to capacity planned despite stagnant demand, that overcapacity is likely to grow in the coming years. While India produced 73 to 78 million metric tons in 2011 and 2012 (World Steel Association 2013b), this was only 82 to 88 percent of its overall capacity, which totaled around 89 million metric tons in 2011 to 2012 (Economic Times 2013). Major producers in India expect to add an additional 24 million metric tons of capacity by 2017–2018, and India’s overall capacity is projected to more than double to reach 200 million metric tons by 2020 (ibid.).

According to a 2013 report, there have also been “sharp increases in capacity in Korea with demand remaining stagnant,” leading to persistent oversupply problems (Ernst & Young 2013). The report continues, “The sharp correction in steel prices [in Korea] is a result of capacity oversupply and excess inventory in the system …. Despite poor demand, Korean steelmakers have continued to expand their supply …. Although this pace of production is slow, it is still enough to worsen the oversupply situation.”

More detailed public data regarding the excess capacity plaguing Korea’s steel industry is available for the oil country tubular goods (OCTG) industry, the industry that provides oil pipelines. OCTG is a product that is not used domestically in Korea, but is solely manufactured for export. Korean OCTG capacity grew by 21.1 percent from 2010 to 2012, enabling a 47.4 percent increase in Korean exports, over 90 percent of which were destined for the United States (USITC 2013a). As detailed in Section III.A, the Korean and Indian governments, as with the Chinese government, have also provided significant subsidies to their steel industries over the years.

Additional investments are being made in other countries across the globe, and plans for capacity additions have been announced by steelmakers in every region of the world (Breakbulk 2013; De Carvalho 2013). As one article explained, “Companies in Vietnam, Argentina, Ecuador, Peru and Bolivia, all backed in some way by governments, are planning new mills” (Industry Today 2013).

3. In summary

The massive increase in global steel production capacity driven by Asia (and particularly China) since the 1990s has continued since the 2008 financial crisis as governments in China and other countries pour resources into new capacity regardless of market fundamentals. As a result, in the context of a slow and faltering global recovery, excess capacity has remained exceedingly high. In 2013, global excess capacity hit over half a billion metric tons, more than twice the amount seen in the early 2000s in the wake of the Asian financial crisis of 1998.

The huge and growing overhang is a major concern for steel producers around the world. And it is driving the global industry’s performance to levels that some have characterized as even worse than that experienced during the previous crisis. This overcapacity will likely continue if not worsen in coming years as more investments are made and the recovery continues at a slow pace.

B. Global overcapacity is harming U.S. steel producers and workers

The rapid growth in excess global steel production capacity has resulted in rising U.S. imports, falling import prices, and declining average unit values, which have depressed domestic steel production and revenues, leading to sharp declines in net income in the U.S. steel industry over the past two years, with $1.2 billion in net losses in 2013 alone. Workers in the domestic steel industry have suffered lost jobs and reduced wages (as noted in the OCTG and wire rod cases described later in this report), and are threatened by a new round of layoffs if losses in the domestic industry are not reversed.

1. Imports are capturing a growing share of the U.S. steel market

Imports of finished and semifinished steel products captured a growing share of the U.S. market between 2003 and 2013, as shown in Figure E. The import share of the U.S. market for semifinished and finished steel products (top line in Figure E) increased by half (50.0 percent) between 2003 and 2013, rising from 19.9 percent to 29.9 percent, an increase of 10.0 percentage points. The growth in gross imports reflects, in part, growing imports of slabs, ingots, billets, and other semifinished steel products.

Import share of U.S. steel products market, 2003–2013

| Year | Semifinished and finished steel products | Finished steel products |

|---|---|---|

| 2003 | 19.9% | 15.8% |

| 2004 | 27.2% | 21.5% |

| 2005 | 26.6% | 20.9% |

| 2006 | 33.4% | 26.5% |

| 2007 | 27.3% | 21.8% |

| 2008 | 28.8% | 23.4% |

| 2009 | 24.2% | 21.1% |

| 2010 | 26.5% | 20.9% |

| 2011 | 28.4% | 21.8% |

| 2012 | 31.0% | 23.9% |

| 2013 | 29.9% | 23.1% |

Source: Economic Policy Institute analysis of forthcoming data provided by American Iron and Steel Institute (AISI 2014a)

Although not shown, the data sources for Figure E reveal that U.S. imports of semifinished products increased 52.0 percent between 2003 and 2013. The growing trade in semifinished steel reflects, in part, the accumulation of global excess steel production capacity (Figure B, earlier), and tremendous growth in crude steel production over the past decade, much of it in China (Figure D, earlier). Imports of steel products, especially semifinished steel, as a share of the overall U.S. market surged in 2006 (as shown in Figure E), when U.S. consumption (production plus imports minus exports) of steel products (not shown) reached 135.7 million net tons, the highest level in the past decade. Strong domestic demand is a magnet for steel imports.

The import share of the U.S. market for finished steel products (bottom line in Figure E) increased by nearly half (46.3 percent), from 15.8 percent in 2003 to 23.1 percent in 2013, an increase of 7.3 percentage points.

Figure F shows the absolute growth in U.S. steel imports (in millions of net tons). Imports increased 17.4 percent between 2011 and 2012. Imports declined slightly in 2013, but remained well above levels in 2011. The United States imported 32.0 million net tons of steel in 2013, an increase of 12.3 percent from 2011.

Annual and year-to-date U.S. imports of steel products, 2011–2014

| Annual | Imports of total steel products (millions of net tons) |

|---|---|

| 2011 | 28.5 |

| 2012 | 33.5 |

| 2013 | 32.0 |

| Jan.–Feb. 2013 | 5.1 |

| Jan.–Feb. 2014 | 6.4 |

Source: Economic Policy Institute analysis of forthcoming data provided by the American Iron and Steel Institute (AISI 2014a)

Imports surged again in the first two months of 2014, to 6.4 million net tons from 5.1 million net tons in January–February 2013, an increase of 24.5 percent. Domestic shipments (not shown) have fallen 0.9 percent over the same period, according to the American Iron and Steel Institute (AISI 2014b). The estimated import share of the domestic market jumped 4.5 percentage points in January–February 2014 (18.5 percent), relative to the same period in 2013. If imports continue to grow at this rate through all of 2014, domestic producers and steelworkers will inevitably suffer from reduced output, continued operating losses, and layoffs.

2. Imports are capturing market share with lower prices

One way that imports injure domestic producers is by underselling domestic steel products. Since 2011, the average price of imported steel, as reflected in the average unit value (AUV) per net ton of U.S. steel imports, has fallen sharply, as shown in Figure G. Import unit values declined steadily throughout the period shown. The AUV of imported steel declined $169 per ton, (15.0 percent) between 2011 and 2013. In the first two months of 2014, import unit values declined $118 per ton (12.0 percent) compared with the same period in 2013. The rate of decline in the price of imported steel accelerated over the past year, with AUVs falling nearly as fast (in terms of the rate of change per year) in interim 2014 as they did in the preceding full two-year period.

Average unit values for all U.S. imports of steel products, 2011–2014

| Annual | Average unit values of steel imports (C.I.F $/net ton) |

|---|---|

| 2011 | $1,123 |

| 2012 | $1,070 |

| 2013 | $955 |

| Jan.–Feb. 2013 | $982 |

| Jan.–Feb. 2014 | $864 |

Source: Economic Policy Institute analysis of forthcoming data provided by American Iron and Steel Institute (AISI 2014a)

Overall, AUVs for imported steel declined by $259 per ton between 2011 and January–February 2014, a total decline of 23.1 percent (combining overlapping periods). Rapidly declining import AUVs have depressed domestic steel prices and profitability, as explored in the next subsection. Surging imports of unfairly traded steel are a clear and present threat to the health of the domestic steel industry.

3. Rising imports of unfairly traded, low-cost steel are suppressing domestic prices

As reviewed in more detail in Section I.C later in this report, there has been a surge in antidumping and countervailing duty cases filed since January of 2013, with petitions on nine different steel products from 18 different countries in 2013 and the first quarter of 2014. Taken together, these cases show that the surge of imports (shown in Figure F) reflects unfair trade practices.

This subsection of the report explores how the surge of imports has depressed domestic steel industry prices and net income. Prices of all steel products were depressed in 2009 by the Great Recession, recovered in 2010, stabilized in 2011, and began to decline in early- to mid-2012 as the volume of U.S. steel imports surged and import AUVs fell.

Figure H shows how trends in prices differ for upstream products (steel ingots and semifinished products) and downstream products (oil country tubular goods, etc.). Prices of steel ingots and other semifinished (upstream) products have largely been flat since 2011, peaking in August 2012 and falling only 1.8 percent through February 2014. Steel pipe and tube products such as OCTG standard and line pipe are made from semifinished products such as steel strip, plate, and billets.1 Thus, the cost of primary inputs used to make finished pipe products was stable over the past three years. However, the price of the final products fell, thus reinforcing substantial cause for concern about the impacts of dumping and subsidies in these markets.

Prices of U.S.-made upstream (ingots and semifinished) and downstream (finished) steel products, 2010–2014

| Month | Steel ingots and semifinished products other than wire rod | Oil country tubular goods (OCTG), standard, line pipe |

|---|---|---|

| 2010/12/01 | 100 | 100.0 |

| 2011/01/01 | 101 | 104.7 |

| 2011/02/01 | 106.3 | 114.6 |

| 2011/03/01 | 109.1 | 119.6 |

| 2011/04/01 | 110.6 | 120.3 |

| 2011/05/01 | 109.3 | 119.5 |

| 2011/06/01 | 113.3 | 117.1 |

| 2011/07/01 | 113.5 | 116.9 |

| 2011/08/01 | 113.7 | 116.9 |

| 2011/09/01 | 113.7 | 118.5 |

| 2011/10/01 | 114.3 | 118.5 |

| 2011/11/01 | 113.1 | 118.6 |

| 2011/12/01 | 112.5 | 118.2 |

| 2012/01/01 | 113.6 | 118.2 |

| 2012/02/01 | 113.8 | 119.9 |

| 2012/03/01 | 116.5 | 119.8 |

| 2012/04/01 | 115.9 | 120.8 |

| 2012/05/01 | 115.3 | 120.1 |

| 2012/06/01 | 114.2 | 119.5 |

| 2012/07/01 | 115.3 | 115.0 |

| 2012/08/01 | 116.7 | 113.1 |

| 2012/09/01 | 115.4 | 112.0 |

| 2012/10/01 | 113.7 | 110.4 |

| 2012/11/01 | 113.7 | 110.2 |

| 2012/12/01 | 112.9 | 110.0 |

| 2013/01/01 | 113 | 107.4 |

| 2013/02/01 | 112.9 | 104.2 |

| 2013/03/01 | 114 | 102.5 |

| 2013/04/01 | 113.6 | 102.0 |

| 2013/05/01 | 112.4 | 101.3 |

| 2013/06/01 | 111.4 | 100.5 |

| 2013/07/01 | 111.4 | 101.0 |

| 2013/08/01 | 110.6 | 101.6 |

| 2013/09/01 | 110.4 | 102.0 |

| 2013/10/01 | 110.9 | 101.4 |

| 2013/11/01 | 110.9 | 101.25 |

| 2013/12/01 | 111.3 | 101.1 |

| 2014/01/01 | 112.3 | 102.3 |

| 2014/02/01 | 114.6 | 101.5 |

Note: These price indexes are for carbon steel products.

Source: Economic Policy Institute analysis of Bureau of Labor Statistics Producer Price Index (BLS 2013)

There was a steep drop in the price of finished products such as carbon steel OCTG, standard pipe, and line pipe, which peaked in April 2012 and declined 16.0 percent through February 2014. The sharp drop in pipe prices is strongly correlated with the 23.1 decline in total import average unit values between 2011 and February, 2014, shown in Figure G. This suggests that domestic producers of finished steel products were subjected to a price-cost squeeze over the past two years, which had a strong, negative effect on net income in this period, as shown in Figure J, in subsection B.4. below.

Likewise, the more than 50 percent increase in the U.S. import share of finished and semifinished steel products between 2003 and 2013 (Figure E) combined with the 10 percent decline in the domestic industry’s net shipments in the same period (AISI 2014a) suggest that surging imports of unfairly traded steel have taken market share and production away from U.S. steel producers.

4. Financial performance in the U.S. steel industry has taken a hit

U.S. steel shipments were high and stable between 2003 and 2007, averaging 107.7 million net tons per year (Figure I). Net sales (total revenues) increased steadily and reached a peak of $66.6 billion in 2008, coinciding with the boom in U.S shale gas drilling.2 Steel shipments (in millions of net tons) and net sales (in billions of dollars) fell sharply in 2009, in the wake of the Great Recession,3 and while shipments have nearly recovered to their 2008 levels, net sales have fallen from their post-recession peak of $54.4 billion in 2011 to $49.4 billion in 2013.

U.S. steel shipments and net sales, 2003–2013

| Year | Shipments (millions of net tons) | Net sales (billions of dollars) |

|---|---|---|

| 2003 | 106.0 | 33.1 |

| 2004 | 111.4 | 38.5 |

| 2005 | 105.0 | 41.2 |

| 2006 | 109.5 | 42.7 |

| 2007 | 106.4 | 48.1 |

| 2008 | 98.5 | 66.6 |

| 2009 | 62.2 | 32.2 |

| 2010 | 83.4 | 46.6 |

| 2011 | 91.9 | 54.4 |

| 2012 | 95.9 | 52.0 |

| 2013 | 95.4 | 49.4 |

Source: Economic Policy Institute analysis of forthcoming data provided by American Iron and Steel Institute (AISI 2014a)

The post-recession trends, including the downturn in shipments (down 0.5 percent in 2013) and net sales (down a cumulative 9.1 percent in 2012 and 2013) due to the latest surge in imports have created financial distress for domestic steel producers. One measure of that stress is provided by trends in gross revenues (net sales) per net ton shipped (derived from the data in figure I but not shown). After peaking at $676 in 2008, revenues per net ton fell to $518 in 2009, recovered somewhat in 2010 and 2011, but fell back down to $518 in 2013.

That revenues per net ton declined 8.5 percent from 2011 to 2012 and 4.4 percent from 2012 to 2013 is an important indicator of the negative impact of the most recent surge of imports of excess, and in some cases, unfairly traded, steel (see Section I.C, below, for a summary of recent unfair trade complaints involving steel products).

Declining revenues do not necessarily imply that domestic producers will experience deteriorating financial performance. Cost reductions can offset the effects of declining sales on net income. U.S. steel producers are among the most efficient in the world. U.S. steelmakers have steadily improved energy efficiency (which has increased 27 percent since 1990) and reduced man-hours per ton by 35.7 percent between 2000 and 2012 (AISI 2013, 14–15). Despite these improvements, domestic producers have not been able to offset the effects of rapid declines in revenues per ton and shipments in 2012 and 2013.

U.S. steel producers’ income (net and as a share of sales) is reported in Figure J. Domestic producers’ net income averaged 7.7 percent of sales between 2004 and 2008. The industry lost $1.7 billion (5.4 percent of sales) in 2009 in the wake of the recession. Domestic steel producers finally returned to profitability in 2011, after two years of recession-induced losses.

U.S. steel producers' net income, and income as a share of net sales, 2003–2013

| Year | Net income (millions of dollars) | Net income as a % of net sales |

|---|---|---|

| 2003 | $-6,881 | -20.8% |

| 2004 | $3,216 | 8.3% |

| 2005 | $2,918 | 7.0% |

| 2006 | $3,861 | 9.0% |

| 2007 | $3,360 | 7.0% |

| 2008 | $4,701 | 7.1% |

| 2009 | $-1,746 | -5.4% |

| 2010 | $-251 | -0.5% |

| 2011 | $914 | 1.7% |

| 2012 | $-388 | -0.7% |

| 2013 | $-1,198 | -2.4% |

Source: Economic Policy Institute analysis of forthcoming data provided by American Iron and Steel Institute (AISI 2014a)

As a capital-intensive, cyclical business, domestic steel producers depend on earning stable, consistent profits during recoveries in order to cover losses during downturns. However, the sharp, 4.4 percent decline in net sales in 2012 (from Figure I, above) pushed the industry back into the red in 2012, when domestic producers lost $388 million (0.7 percent of net sales). Falling shipments and net sales resulted in a much greater net loss of $1.2 billion in 2013 (2.4 percent of net sales).

Domestic steel producers have now absorbed net losses totaling $3.6 billion in four out of the last five years (2009–2013), including roughly $1.6 billion in losses in 2012 and 2013 alone, as shown in Figure J.

5. Recent business-cycle indicators suggest that the U.S. steel import crisis is accelerating

Because of the capital-intensive nature of steel production, plants must be operated nearly 24 hours per day, 7 days per week for peak efficiency. Some downtime is required for maintenance and changes in product mix, but capacity utilization rates of about 92 percent or more are required for “healthy” production, as noted earlier. Capacity utilization in the U.S. steel industry was reasonably healthy in 2007 and through the summer of 2008, averaging 87.6 percent, but dipped into the 30 percent to 70 percent range from late 2008 through late 2010 and has remained low, ranging between 70 and 80 percent, as shown in Figure K.

Capacity utilization in U.S. steel industry, 2007–2014

| Month | Capacity utilization in production of iron and steel products |

|---|---|

| 2007/01/01 | 84.8% |

| 2007/02/01 | 84.2% |

| 2007/03/01 | 84.9% |

| 2007/04/01 | 86.2% |

| 2007/05/01 | 85.6% |

| 2007/06/01 | 84.6% |

| 2007/07/01 | 85.3% |

| 2007/08/01 | 84.8% |

| 2007/09/01 | 82.3% |

| 2007/10/01 | 88.4% |

| 2007/11/01 | 91.7% |

| 2007/12/01 | 92.1% |

| 2008/01/01 | 92.7% |

| 2008/02/01 | 92.9% |

| 2008/03/01 | 90.1% |

| 2008/04/01 | 92.7% |

| 2008/05/01 | 89.2% |

| 2008/06/01 | 88.5% |

| 2008/07/01 | 90.6% |

| 2008/08/01 | 87.0% |

| 2008/09/01 | 80.5% |

| 2008/10/01 | 70.5% |

| 2008/11/01 | 56.2% |

| 2008/12/01 | 46.3% |

| 2009/01/01 | 44.7% |

| 2009/02/01 | 44.8% |

| 2009/03/01 | 40.3% |

| 2009/04/01 | 40.1% |

| 2009/05/01 | 41.0% |

| 2009/06/01 | 44.7% |

| 2009/07/01 | 52.2% |

| 2009/08/01 | 55.0% |

| 2009/09/01 | 59.0% |

| 2009/10/01 | 62.5% |

| 2009/11/01 | 62.7% |

| 2009/12/01 | 65.2% |

| 2010/01/01 | 66.1% |

| 2010/02/01 | 68.7% |

| 2010/03/01 | 73.2% |

| 2010/04/01 | 71.8% |

| 2010/05/01 | 74.0% |

| 2010/06/01 | 72.6% |

| 2010/07/01 | 66.7% |

| 2010/08/01 | 67.7% |

| 2010/09/01 | 69.9% |

| 2010/10/01 | 67.5% |

| 2010/11/01 | 71.0% |

| 2010/12/01 | 73.4% |

| 2011/01/01 | 74.0% |

| 2011/02/01 | 73.2% |

| 2011/03/01 | 74.1% |

| 2011/04/01 | 72.3% |

| 2011/05/01 | 71.4% |

| 2011/06/01 | 73.9% |

| 2011/07/01 | 73.7% |

| 2011/08/01 | 75.9% |

| 2011/09/01 | 75.7% |

| 2011/10/01 | 76.8% |

| 2011/11/01 | 77.6% |

| 2011/12/01 | 80.9% |

| 2012/01/01 | 78.6% |

| 2012/02/01 | 80.1% |

| 2012/03/01 | 77.5% |

| 2012/04/01 | 79.5% |

| 2012/05/01 | 78.6% |

| 2012/06/01 | 75.4% |

| 2012/07/01 | 75.6% |

| 2012/08/01 | 77.0% |

| 2012/09/01 | 70.5% |

| 2012/10/01 | 71.7% |

| 2012/11/01 | 75.4% |

| 2012/12/01 | 75.7% |

| 2013/01/01 | 75.5% |

| 2013/02/01 | 74.6% |

| 2013/03/01 | 72.7% |

| 2013/04/01 | 74.3% |

| 2013/05/01 | 75.1% |

| 2013/06/01 | 74.6% |

| 2013/07/01 | 78.3% |

| 2013/08/01 | 76.4% |

| 2013/09/01 | 76.6% |

| 2013/10/01 | 79.9% |

| 2013/11/01 | 78.1% |

| 2013/12/01 | 75.9% |

| 2014/01/01 | 74.6% |

| 2014/02/01 | 73.0% |

Source: Economic Policy Institute analysis of Federal Reserve Board (FRB 2014)

In fact, U.S. steel capacity utilization has declined every month since October 2013, falling from 79.9 percent to 73.0 percent in February 2014, a cumulative decline of 6.9 percentage points (8.6 percent) in capacity utilization. While not yet at recession levels, this sharp decline suggests that, if continued, the steel industry’s losses could deepen in 2014.

6. Surging, low-cost imports are threatening domestic steel employment

Rapidly growing imports of semifinished and finished steel products over the past decade have harmed domestic producers and steelworkers by displacing production and sales of domestically manufactured steel products, reducing U.S. steel production and employment.

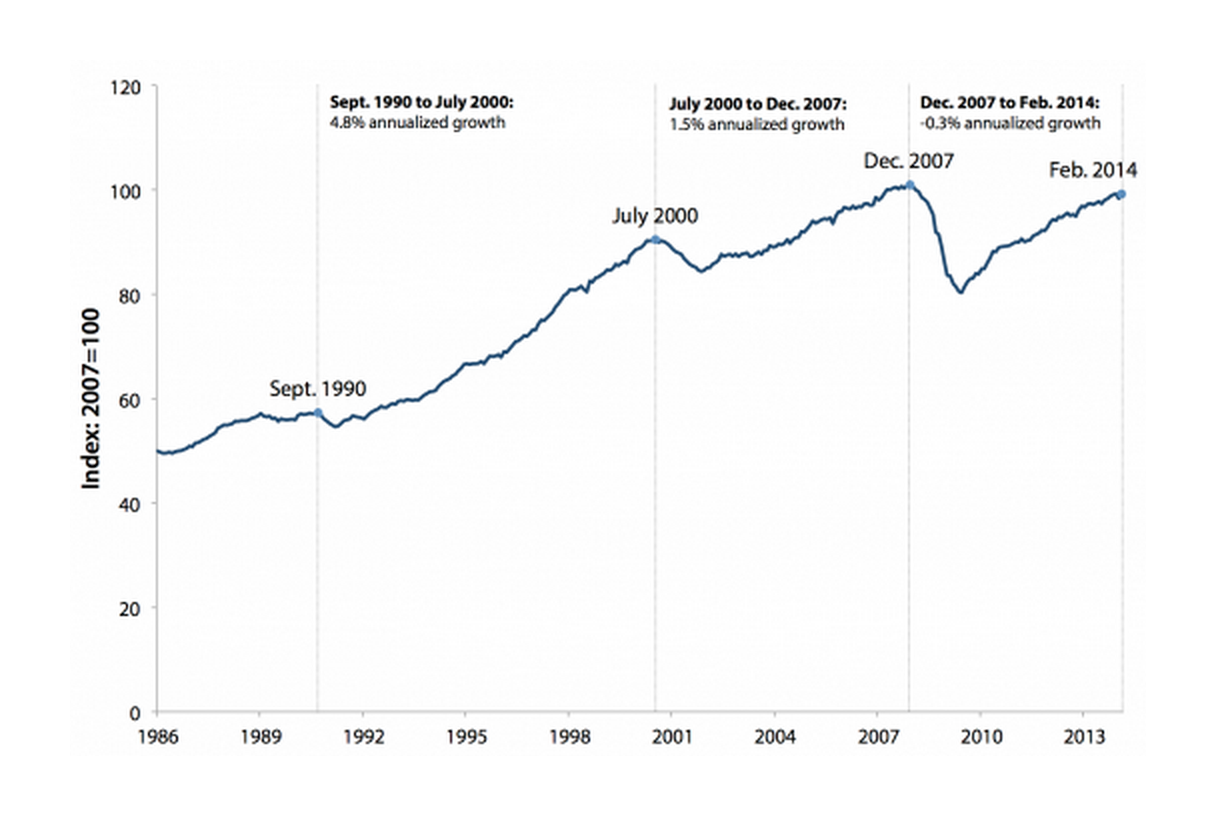

Figure L shows the decline in steel industry employment since 1990, reflecting the periodic crises raised by chronic and growing overcapacity, as covered earlier. The last major steel crisis occurred in 1999–2003, a period when surging imports pushed 33 U.S. steel companies into bankruptcy (USITC 2005, 5). On March 20, 2002, President George W. Bush imposed tariffs and a tariff-rate quota on steel from many countries in response to a safeguard investigation under section 201 of the Trade Act of 1974 (USITC 2005, 1).

U.S. steel employment, 1990–2014

| Month | Total steel employment (thousands of employees) |

|---|---|

| 1990/01/01 | 258.2 |

| 1990/02/01 | 257.7 |

| 1990/03/01 | 257.6 |

| 1990/04/01 | 257.5 |

| 1990/05/01 | 257.5 |

| 1990/06/01 | 257.8 |

| 1990/07/01 | 258.4 |

| 1990/08/01 | 257.2 |

| 1990/09/01 | 256.4 |

| 1990/10/01 | 256.6 |

| 1990/11/01 | 256.6 |

| 1990/12/01 | 255.0 |

| 1991/01/01 | 256.2 |

| 1991/02/01 | 248.7 |

| 1991/03/01 | 248.0 |

| 1991/04/01 | 247.6 |

| 1991/05/01 | 245.8 |

| 1991/06/01 | 244.3 |

| 1991/07/01 | 243.8 |

| 1991/08/01 | 243.1 |

| 1991/09/01 | 242.6 |

| 1991/10/01 | 239.7 |

| 1991/11/01 | 238.1 |

| 1991/12/01 | 238.2 |

| 1992/01/01 | 238.2 |

| 1992/02/01 | 237.8 |

| 1992/03/01 | 237.1 |

| 1992/04/01 | 235.9 |

| 1992/05/01 | 235.0 |

| 1992/06/01 | 234.6 |

| 1992/07/01 | 233.1 |

| 1992/08/01 | 232.8 |

| 1992/09/01 | 231.5 |

| 1992/10/01 | 229.1 |

| 1992/11/01 | 227.3 |

| 1992/12/01 | 225.6 |

| 1993/01/01 | 225.4 |

| 1993/02/01 | 225.3 |

| 1993/03/01 | 224.9 |

| 1993/04/01 | 224.2 |

| 1993/05/01 | 223.9 |

| 1993/06/01 | 222.8 |

| 1993/07/01 | 222.9 |

| 1993/08/01 | 222.9 |

| 1993/09/01 | 222.9 |

| 1993/10/01 | 222.7 |

| 1993/11/01 | 223.9 |

| 1993/12/01 | 224.0 |

| 1994/01/01 | 225.0 |

| 1994/02/01 | 224.0 |

| 1994/03/01 | 222.8 |

| 1994/04/01 | 220.9 |

| 1994/05/01 | 220.5 |

| 1994/06/01 | 222.0 |

| 1994/07/01 | 223.1 |

| 1994/08/01 | 221.8 |

| 1994/09/01 | 222.6 |

| 1994/10/01 | 223.0 |

| 1994/11/01 | 223.0 |

| 1994/12/01 | 224.0 |

| 1995/01/01 | 223.8 |

| 1995/02/01 | 223.7 |

| 1995/03/01 | 224.0 |

| 1995/04/01 | 224.3 |

| 1995/05/01 | 224.6 |

| 1995/06/01 | 225.0 |

| 1995/07/01 | 224.0 |

| 1995/08/01 | 224.8 |

| 1995/09/01 | 223.6 |

| 1995/10/01 | 223.3 |

| 1995/11/01 | 224.7 |

| 1995/12/01 | 224.7 |

| 1996/01/01 | 224.9 |

| 1996/02/01 | 224.3 |

| 1996/03/01 | 223.8 |

| 1996/04/01 | 223.7 |

| 1996/05/01 | 224.1 |

| 1996/06/01 | 223.5 |

| 1996/07/01 | 223.3 |

| 1996/08/01 | 223.7 |

| 1996/09/01 | 222.9 |

| 1996/10/01 | 219.6 |

| 1996/11/01 | 219.4 |

| 1996/12/01 | 219.0 |

| 1997/01/01 | 219.6 |

| 1997/02/01 | 219.2 |

| 1997/03/01 | 219.2 |

| 1997/04/01 | 218.5 |

| 1997/05/01 | 217.4 |

| 1997/06/01 | 217.7 |

| 1997/07/01 | 217.2 |

| 1997/08/01 | 216.9 |

| 1997/09/01 | 218.0 |

| 1997/10/01 | 218.5 |

| 1997/11/01 | 218.8 |

| 1997/12/01 | 217.9 |

| 1998/01/01 | 218.2 |

| 1998/02/01 | 217.9 |

| 1998/03/01 | 217.6 |

| 1998/04/01 | 217.2 |

| 1998/05/01 | 217.7 |

| 1998/06/01 | 218.1 |

| 1998/07/01 | 217.0 |

| 1998/08/01 | 216.8 |

| 1998/09/01 | 216.8 |

| 1998/10/01 | 214.4 |

| 1998/11/01 | 212.3 |

| 1998/12/01 | 212.7 |

| 1999/01/01 | 212.2 |

| 1999/02/01 | 212.0 |

| 1999/03/01 | 212.0 |

| 1999/04/01 | 211.7 |

| 1999/05/01 | 211.5 |

| 1999/06/01 | 210.2 |

| 1999/07/01 | 210.4 |

| 1999/08/01 | 210.1 |

| 1999/09/01 | 210.3 |

| 1999/10/01 | 210.2 |

| 1999/11/01 | 210.8 |

| 1999/12/01 | 210.7 |

| 2000/01/01 | 211.1 |

| 2000/02/01 | 211.0 |

| 2000/03/01 | 211.7 |

| 2000/04/01 | 210.0 |

| 2000/05/01 | 209.0 |

| 2000/06/01 | 209.1 |

| 2000/07/01 | 209.4 |

| 2000/08/01 | 208.6 |

| 2000/09/01 | 205.3 |

| 2000/10/01 | 205.1 |

| 2000/11/01 | 204.4 |

| 2000/12/01 | 203.3 |

| 2001/01/01 | 201.4 |

| 2001/02/01 | 200.3 |

| 2001/03/01 | 198.7 |

| 2001/04/01 | 196.3 |

| 2001/05/01 | 194.1 |

| 2001/06/01 | 191.1 |

| 2001/07/01 | 188.0 |

| 2001/08/01 | 185.3 |

| 2001/09/01 | 183.0 |

| 2001/10/01 | 181.2 |

| 2001/11/01 | 178.2 |

| 2001/12/01 | 175.4 |

| 2002/01/01 | 173.3 |

| 2002/02/01 | 171.7 |

| 2002/03/01 | 170.2 |

| 2002/04/01 | 169.5 |

| 2002/05/01 | 170.1 |

| 2002/06/01 | 169.9 |

| 2002/07/01 | 169.9 |

| 2002/08/01 | 170.3 |

| 2002/09/01 | 170.3 |

| 2002/10/01 | 170.1 |

| 2002/11/01 | 170.0 |

| 2002/12/01 | 169.4 |

| 2003/01/01 | 169.3 |

| 2003/02/01 | 168.5 |

| 2003/03/01 | 167.6 |

| 2003/04/01 | 166.6 |

| 2003/05/01 | 164.3 |

| 2003/06/01 | 162.2 |

| 2003/07/01 | 161.7 |

| 2003/08/01 | 161.3 |

| 2003/09/01 | 159.8 |

| 2003/10/01 | 158.9 |

| 2003/11/01 | 158.3 |

| 2003/12/01 | 157.4 |

| 2004/01/01 | 157.2 |

| 2004/02/01 | 156.6 |

| 2004/03/01 | 156.3 |

| 2004/04/01 | 156.1 |

| 2004/05/01 | 155.4 |

| 2004/06/01 | 155.9 |

| 2004/07/01 | 156.4 |

| 2004/08/01 | 156.6 |

| 2004/09/01 | 157.1 |

| 2004/10/01 | 156.5 |

| 2004/11/01 | 156.5 |

| 2004/12/01 | 157.0 |

| 2005/01/01 | 156.3 |

| 2005/02/01 | 156.3 |

| 2005/03/01 | 155.9 |

| 2005/04/01 | 156.5 |

| 2005/05/01 | 158.0 |

| 2005/06/01 | 157.4 |

| 2005/07/01 | 155.6 |

| 2005/08/01 | 157.2 |

| 2005/09/01 | 156.2 |

| 2005/10/01 | 157.9 |

| 2005/11/01 | 157.8 |

| 2005/12/01 | 157.2 |

| 2006/01/01 | 157.3 |

| 2006/02/01 | 156.4 |

| 2006/03/01 | 155.3 |

| 2006/04/01 | 156.1 |

| 2006/05/01 | 157.5 |

| 2006/06/01 | 157.1 |

| 2006/07/01 | 158.1 |

| 2006/08/01 | 156.4 |

| 2006/09/01 | 157.2 |

| 2006/10/01 | 157.5 |

| 2006/11/01 | 157.2 |

| 2006/12/01 | 158.4 |

| 2007/01/01 | 159.8 |

| 2007/02/01 | 161.5 |

| 2007/03/01 | 160.8 |

| 2007/04/01 | 162.6 |

| 2007/05/01 | 162.3 |

| 2007/06/01 | 161.1 |

| 2007/07/01 | 162.4 |

| 2007/08/01 | 161.9 |

| 2007/09/01 | 160.4 |

| 2007/10/01 | 159.6 |

| 2007/11/01 | 161.6 |

| 2007/12/01 | 161.6 |

| 2008/01/01 | 161.5 |

| 2008/02/01 | 161.3 |

| 2008/03/01 | 163.3 |

| 2008/04/01 | 162.4 |

| 2008/05/01 | 162.6 |

| 2008/06/01 | 162.4 |

| 2008/07/01 | 161.2 |

| 2008/08/01 | 160.6 |

| 2008/09/01 | 160.0 |

| 2008/10/01 | 158.2 |

| 2008/11/01 | 156.0 |

| 2008/12/01 | 152.9 |

| 2009/01/01 | 150.1 |

| 2009/02/01 | 146.0 |

| 2009/03/01 | 143.9 |

| 2009/04/01 | 136.2 |

| 2009/05/01 | 132.2 |

| 2009/06/01 | 129.8 |

| 2009/07/01 | 129.9 |

| 2009/08/01 | 129.8 |

| 2009/09/01 | 129.8 |

| 2009/10/01 | 131.3 |

| 2009/11/01 | 131.6 |

| 2009/12/01 | 132.1 |

| 2010/01/01 | 132.3 |

| 2010/02/01 | 134.4 |

| 2010/03/01 | 136.0 |

| 2010/04/01 | 138.1 |

| 2010/05/01 | 139.4 |

| 2010/06/01 | 139.7 |

| 2010/07/01 | 140.1 |

| 2010/08/01 | 140.0 |

| 2010/09/01 | 140.6 |

| 2010/10/01 | 140.3 |

| 2010/11/01 | 141.1 |

| 2010/12/01 | 141.6 |

| 2011/01/01 | 143.4 |

| 2011/02/01 | 144.5 |

| 2011/03/01 | 145.5 |

| 2011/04/01 | 148.0 |

| 2011/05/01 | 148.3 |

| 2011/06/01 | 148.8 |

| 2011/07/01 | 149.5 |

| 2011/08/01 | 149.8 |

| 2011/09/01 | 150.6 |

| 2011/10/01 | 151.4 |

| 2011/11/01 | 152.2 |

| 2011/12/01 | 152.0 |

| 2012/01/01 | 152.2 |

| 2012/02/01 | 152.6 |

| 2012/03/01 | 152.6 |

| 2012/04/01 | 151.9 |

| 2012/05/01 | 153.8 |

| 2012/06/01 | 153.3 |

| 2012/07/01 | 154.4 |

| 2012/08/01 | 152.7 |

| 2012/09/01 | 151.9 |

| 2012/10/01 | 151.9 |

| 2012/11/01 | 150.6 |

| 2012/12/01 | 150.5 |

| 2013/01/01 | 150.1 |

| 2013/02/01 | 149.0 |

| 2013/03/01 | 149.8 |

| 2013/04/01 | 149.0 |

| 2013/05/01 | 149.1 |

| 2013/06/01 | 149.1 |

| 2013/07/01 | 147.7 |

| 2013/08/01 | 149.0 |

| 2013/09/01 | 149.2 |

| 2013/10/01 | 148.3 |

| 2013/11/01 | 149.2 |

| 2013/12/01 | 150.7 |

| 2014/01/01 | 150.1 |

| 2014/02/01 | 149.8 |

| 2014/03/01 | 149.8 |

Note: Employment data combine blast furnaces and steel mills (NAICS 3311) and steel products from purchased steel (NAICS 3312).

Source: Economic Policy Institute analysis of Bureau of Labor Statistics Current Establishment Survey public data (BLS 2014)

As discussed in more detail in Section IV.B., later in this report, the domestic steel industry reorganized and restructured in the wake of the safeguard cases of 2002. The assets of numerous bankrupt steelmakers were acquired by other steelmakers. The assets of some firms were liquidated. U.S. steel production declined in 2001, but recovered over the next few years (USITC 2005). The United Steelworkers union (USW) negotiated a groundbreaking new labor agreement with major steel companies. However, as Figure L shows, about 55,000 steelworker jobs were lost between January 1999 and December 2004, a 26 percent decline in total steel employment. Most of the job losses were the result of the steel crisis and subsequent restructuring.

Although the U.S. steel industry recovered, substantial restructuring permanently reduced U.S. steel industry employment. This shows why such periodic crises in the steel industry are the gravest long-run threat to steel industry employment.

We are in another such crisis. While most of the nearly 30,000 steel industry jobs lost between 2007 and the end of 2009 due to the Great Recession were recovered by July 2012, employment trended down between mid-2012 and March 2014, the last period for which we have employment data. Recent job losses are correlated with sharp increase in imports, especially in 2012, as shown in Figure F earlier).

Between December 2013 and March 2014, 900 jobs (0.6 percent of industry employment) were lost in steel mills and steel product manufacturing (NAICS industries 3311 and 3312), as shown in Figure L. Most (700) of those jobs were lost in industries making steel products such as pipe and tube products, rebar, and wire rod, products subject to antidumping and countervailing complaints discussed in section C, below. Surging imports of unfairly trade steel products have contributed to the loss of nearly 1,000 jobs in the U.S. steel industry in the first three months of 2014 alone.

Additional evidence of the crisis in the steel industry is available in the Trade Adjustment Assistance certifications for workers who have lost their jobs due to rising U.S. imports of steel and shifts in steel production from the U.S. to other countries. (Trade Adjustment Assistance is a U.S. Department of Labor program available to workers displaced due to rising imports.) The number of certified petitions likely understates the full extent of trade-related job loss in the steel sector in recent months, as workers and companies have up to a year from the date of separation to file a petition for assistance and the Department of Labor has 60 days thereafter to make a determination. Nonetheless, the recent petitions listed in Table 1, which cover an estimated 4,184 workers in eight states, provide a snapshot of one more aspect of the crisis.

Trade Adjustment Assistance certifications for steel industry workers, 2012 through first quarter 2014

| Company and location | Product | Workers affected | Plant closing | Certification # and date |

|---|---|---|---|---|

| Evraz Claymont Steel Claymont, Del. |

Carbon plate steel | 375 | Dec. 13, 2013 | 83250 Feb. 21, 2014 |

| Republic Steel Massillon, Ohio |

Special bar quality cold finish bar | 85 | Sept. 20, 2013 | 82758 July 17, 2013 |

| AK Steel Corporation Zanesville, Ohio |

Specialty steel | 84 | Some divisions, plant unknown | 82633 Aug. 1, 2013 |

| ArecelorMittal Georgetown, S.C. |

Wire rod | 32 | No | 82482 April 4, 2013 |

| Gerdau Ameristeel US Inc. Saint Paul, Minn. |

Long steel products | 31 | No | 82373 April 1, 2013 |

| RG Steel Wheeling, LLC Wheeling, W.V. Fort Payne, Ala. |

Steel products | 2,010 | Aug. 2012 | 82342 Feb. 22, 2013 |

| U.S. Steel Tubular Products, Inc. McKeesport, Pa. |

Tubular products | 142 | Unknown | 82285 Jan. 28, 2013 |

| JMC Steel Group Sharon, Pa. |

Pipe and tube | 60–75 | Yes, unknown when | 81944 Nov. 5, 2012 |

| RG Steel Wheeling, LLC Beech Bottom, W.V. |

Roll formed metal deck | 80 | Unknown | 81879 Sep. 25, 2012 |

| RG Steel Wheeling, LLC Warren, Ohio |

Steel | 1,100 | Unknown | 81704 July 20, 2012 |

| JMC Steel Group Sharon, Pa. |

Steel pipe OCTG | 45 | June 30, 2012 | 81678 July 18, 2012 |

| Isaacson Structural Steel, Inc. Berlin, N.H. |

Structural steel | 140 | Unknown | 81251 Feb. 10, 2012 |

| Total | 4,184–4,199 |

Source: U.S. Department of Labor, Employment & Training Administration (various years)

Steelmakers have announced the potential for additional layoffs in 2014. In November of 2013, USS-POSCO warned that 690 workers could be laid off in early 2014 at its plant in Pittsburg, California, though the layoffs appear to be on hold for now (Dunn 2014). The facility produces cold-rolled steel sheets, galvanized sheets, hot-rolled pickled and oiled sheets, and tin plates. In February of 2014, U.S. Steel confirmed that layoffs would be occurring at its tubular products plant in Lorain, Ohio, but did not confirm how many workers would be affected or when the layoffs would occur (Fogarty 2014).

7. In summary

The rapid growth of excess global steel production capacity over the past decade, especially in China, but also in South Korea, India, and other major steel-exporting nations has destabilized the world steel market.

Persistent patterns of dumping, subsidies, and these unneeded capacity investments have generated falling prices and negative rates of return for steel producers in the United States. These patterns are creating a U.S. steel industry crisis that could be even worse than the downturn at the beginning of this century if action is not taken. As this section has shown, U.S. steelmakers have been hard hit by surging imports over the past two years, with U.S. steel producers absorbing $1.6 billion in losses in 2012 and 2013 alone. Steelworkers have suffered lost wages and their jobs are now at risk. If net losses in operating income continue or deepen in the next few years, a new wave of bankruptcies, layoffs, and plant closings will likely result. In this context, recent unfair trade cases take on a new importance. The next section reviews recent unfair trade cases which, taken together, collectively represent some of the most vulnerable segments of the U.S. steel industry. In return, this review sheds light on the need for effective trade remedy enforcement to enable the industry to survive the current crisis.

C. Injurious imports have spurred a wave of petitions for relief

The crisis arising from global production overcapacity and growing U.S. imports led steel producers and the United Steelworkers union to file petitions for import relief on nine products from 18 countries in 2013 and the first quarter of 2014. Counted on an individual country and product basis, there were 38 individual petitions in 2013 and another two in the first quarter of 2014.4 As Figure M shows, this is by far the largest number of petitions filed on steel imports in such a short period since the crisis which led to petitions for antidumping, countervailing duty, and safeguard relief in 2001.

U.S. antidumping and countervailing duty petitions filed on steel products, 2001–2013

| Year | Number of Steel Petitions Filed |

|---|---|

| 2001 | 55 |

| 2002 | 15 |

| 2003 | 8 |

| 2004 | 4 |

| 2005 | 3 |

| 2006 | |

| 2007 | 7 |

| 2008 | 4 |

| 2009 | 8 |

| 2010 | |

| 2011 | 11 |

| 2012 | |

| 2013 | 38 |

Source: Authors' calculations based on historical case records from the U.S. Department of Commerce and U.S. International Trade Commission.

The recent wave of petitions, though it only covers portions of the adversely affected steel industry, demonstrates the severity and breadth of the crisis. As Table 2 shows, the domestic steel companies that produce the nine products currently subject to petitions are numerous, and include both large and small companies located all over the country. Indeed, facilities producing the affected products are spread across 92 towns in 29 states. Based on publicly available information, more than 14,000 production workers were employed making these products in the United States in 2012 (USITC 2013a, 2013g, 2013h, 2014b).

Antidumping and countervailing duty petitions on steel products filed in 2013 and the first quarter of 2014

| Date filed | Case | Domestic producers | Production locations |

|---|---|---|---|

| March 27, 2013 | Diffusion-annealed, nickel-plated steel from Japan | Thomas Steel | Warren, Ohio |

| April 23, 2013 | Prestressed concrete steel rail tie wire from China, Mexico, and Thailand | Davis Insteel |

Jacksonville, Fla. Kent, Wash. |

| May 16, 2013 | Welded stainless steel pressure pipe from Malaysia, Thailand, and Vietnam | Alaskan Copper & Brass Bristol Metals Fekker Brothers Marcegaglia USA Outokumpu Rath Gibson Webco |

Clarksville, Ark. Wildwood, Fla. Glasgow, Ky. North Branch, NJ Mannford, Okla. Munhall, Pa. Bristol, Tenn. Seattle, Wash. Janesville, Wis. |

| June 27, 2013 | Steel threaded rod from India and Thailand | All America Threaded Products All Ohio Threaded Rod Co. Bay Standard Manufacturing, Inc. Interstate Threaded Products, Inc. Vulcan Threaded Products Inc. |

Pelham, Ala. Brentwood, Calif. Denver, Colo. Indianapolis, Ind. Cleveland, Ohio Lancaster, Pa. Dallas, Texas |

| July 2, 2013 | Certain oil country tubular goods from India, Korea, Philippines, Saudi Arabia, Taiwan, Thailand, Turkey, Ukraine, and Vietnam | Boomerang Tube, LLC Drill Pipe International LLC EnergeX Tube EVRAZ Rocky Mountain Steel Laguna Tubular Products Corp. Maverick Tube Corporation Northwest Pipe Company OMK Paragon Industries, Inc. Tejas Tubular Products, Inc. Texas Steel Conversion, Inc. Texas Tubular Products TMK IPSCO United States Steel Corporation Vallourec Star, LP Welded Tube USA, Inc. |

Fairfield, Ala. Thomasville, Ala. Blytheville, Ark. Hickman, Ark. Pueblo, Colo. Camanche, Iowa Wilder, Ky. Bossier City, La. New Hope, Minn. Lackawanna, N.Y. Lorain, Ohio Warren, Ohio Youngstown, Ohio Catoosa, Okla. Muskogee, Okla. Sapulpa, Okla. Ambridge, Pa. Koppel, Pa. Sharon, Pa. Baytown, Texas Bellville, Texas Bryan, Texas Conroe, Texas Houston, Texas Liberty, Texas Lone Star, Texas Stephenville, Texas |

| Sept. 4, 2013 | Steel concrete reinforcing bar from Mexico and Turkey | Alton Steel ArcelorMittal Byer Steel Cascade CMC Ervaz Gerdau Keystone Nucor SDI |

Birmingham, Ala. Magnolia, Ark. Kingman, Ariz. Mesa, Ariz. Rancho Cucamonga, Calif. Pueblo, Colo. Wallingford, Conn. Baldwin, Fla. Wilton, Iowa. Alton, Ill. Kankakee, Ill. Peoria, Ill. Pittsboro, Ind. St. Paul, Minn. Jackson, Miss. Charlotte, N.C. Sayreville, N.J. Auburn, N.Y. Cincinnati, Ohio Marion, Ohio McMinnville, Ore. Cayce, S.C. Darlington, S.C. Jackson, Tenn. Knoxville, Tenn. Canutillo, Texas Jewett, Texas Midlothian, Texas Seguin, Texas West Vidor, Texas Plymouth, Utah Roanoke, Va. Seattle, Wash. |

| Sept. 18, 2013 | Grain-oriented electrical steel from China, Czech Republic, Germany, Japan, Korea, Poland, and Russia | AK Steel Allegheny Ludlum |

West Chester, Ohio Zanesville, Ohio Brackenridge, Pa. Butler, Pa. Leechburg, Pa. |

| Sept. 30, 2013 | Non-oriented electrical steel from China, Germany, Japan, Korea, Sweden, and Taiwan | AK Steel Nucor |

Crawfordsville, Ind. Zanesville, Ohio. Butler, Pa. |

| Jan. 31, 2014 | Wire rod from China | ArcelorMittal Cascade Charter Ervaz Gerdau Keystone Mid American Nucor Republic Sterling |

Kingman, Ariz. Pueblo, Colo. Wallingford, Conn. Jacksonville, Fla. Peoria, Ill. Sterling, Ill. Chicago, Ill. Norfolk, Neb. Perth Amboy, N.J. (idled) Cuyahoga Heights, Ohio Fostoria, Ohio Lorain, Ohio Madill, Okla. McMinnville, Ore. Darlington, S.C. Georgetown, S.C. Beaumont, Texas Saukville, Wis. |

Sources: U.S. International Trade Commission (2013a, b, c, d, e, f, g, h, 2014b)

In each of the above cases, the U.S. International Trade Commission preliminarily found a reasonable indication that the domestic industry was being injured by the imports from the countries concerned. On April 17, 2014, the commission reached a negative final determination on steel threaded rod from Thailand (USITC 2014c). Final determinations in the other cases will be made later this year and in early 2015.

While many of the cases involve confidential industry information, three of the cases reveal enough public information to provide insight into the range of challenges the domestic industry and its workers are facing.

1. OCTG from nine countries

The case on oil country tubular goods from nine countries reveals how sharply conditions started to deteriorate in the beginning of 2013 (USITC 2013a). The commission’s preliminary investigation only covered the first three months of 2013. Imports from the nine countries more than doubled from 2010 to 2012. Though the quantity of imports from the nine countries fell slightly in the first quarter of 2013 as overall consumption fell, the imports were priced more aggressively and were able to increase their share of the U.S. market. The commission found that imports of OCTG from the nine countries were sold at lower prices than domestic product in the vast majority of cases, sometimes by substantial margins. Because OCTG is a highly fungible product, the pricing pressure caused the domestic industry to lose sales and forced domestic producers to lower prices to compete.

The domestic OCTG industry’s production, capacity utilization, shipments, and sales all fell in the first quarter of 2013 compared with the same period in 2012. The unit value of domestic sales also fell, by more than 10 percent compared with the first quarter of 2012. The industry was unable to cut costs as quickly as prices fell, however, and the ratio of its cost-of-goods-sold to its sales revenue rose from 77.6 percent in the first quarter of 2012 to 86.2 percent in the first quarter of 2013. As a result, the industry’s operating income for the first quarter of 2013 was slashed by nearly $191 million, or 68 percent, compared with the same period in 2012, and its operating income margin plummeted from 16 percent of sales to less than 6 percent. The more than 7,000 workers producing OCTG in the United States worked more hours but saw their total combined wages fall. Based on these trends, the U.S. International Trade Commission concluded that, “there is a reasonable indication that the large and increasing volume of subject imports had a material adverse impact on the domestic industry” (USITC 2013a).

2. Rebar from Mexico and Turkey

The bleak trends in the first quarter of 2013 described in the OCTG case persisted through the second quarter, as demonstrated in the preliminary determination on steel concrete reinforcing bar from Mexico and Turkey (USITC 2013g). In that case, the quantity of rebar from Mexico and Turkey nearly doubled from 2010 to 2012 and it rose again in the first half of 2013 compared with the first half of 2012. The unit value of those imports also fell by 8.7 percent from the first half of 2012 to the first half of 2013. As a result, importers were able to gain market share at the expense of the domestic industry. Domestic rebar producers’ production, capacity utilization, and sales were all lower in the first six months of 2013 than they had been in the same period in 2012. Just as with OCTG, rebar producers were forced to lower prices to compete but were unable to lower costs as sharply. As a result, the industry’s operating income dropped by $41 million, or 35.6 percent, and its already low operating margin of 5.4 percent in the first half of 2012 dropped to only 3.7 percent in the first half of 2013. The commission concluded that, “subject imports have had a significant adverse impact on the domestic industry.”

3. Wire rod from China

The commission’s recent preliminary determination on wire rod from China has been the first steel industry case to examine full year 2013 data (USITC 2014b). The data show that another segment of the steel industry is suffering from unfair import competition. Imports of wire rod from China were nearly nonexistent in 2011, they then jumped in 2012, and they more than doubled in volume between 2012 and 2013. Subject import unit values plummeted by more than half between 2011 and 2013, allowing Chinese wire rod to gain 14.4 points in market share while domestic producers lost 9.8 points of share. Domestic producers’ production, capacity utilization, shipments, and sales all were lower in 2013 than they had been in either 2011 or 2012. Domestic producers were forced to lower prices to compete with imports, but they were again unable to lower costs to the same degree. As a result, the industry’s operating income in 2013 was 30.5 percent lower than it had been in 2012 and less than half of what it had been in 2011. The commission noted, “Despite increases in apparent U.S. consumption, the domestic industry’s trade and financial performance declined substantially.” The industry’s operating margin fell from 6.8 percent in 2011 to just 3.6 percent in 2013. The more than 2,000 workers producing wire rod in the U.S. also suffered as employment, hours worked, and wages all fell to their lowest point in 2013.

4. In summary

The crisis in the U.S. steel industry has sparked a wave of petitions for relief from unfairly traded steel imports in 2013 and 2014. The number of petitions filed far exceeds any annual level since the previous steel crisis in 2001.

II. Why it matters: Steel’s importance and its impact on jobs

The U.S. steel industry has a large footprint in the domestic economy. Steel production has a large input-output multiplier. Each steel job supports 3.7 jobs elsewhere in the economy. And this does not include the respending effect of steel employment on the rest of the economy. Steelworkers earn good wages with excellent benefits. When they spend those wages, they support additional jobs in the economy. If jobs are lost in the steel industry, it will have a large negative impact on employment in the U.S. economy. Those effects are analyzed in this section.

A. Modeling the impacts of steel production on U.S. employment

The direct and indirect employment effects of U.S. steel production are analyzed using an input-output model of the U.S. economy. This model has been developed and calibrated by the U.S. Bureau of Labor Statistics, where it is used to develop projections of employment by industry and occupation in the U.S. economy. The modules developed include measures that estimate final demand (gross domestic product or GDP) by consuming sector and product, industry output, and employment by industry (BLS-EP 2014a).

The goal of this analysis is to estimate the total number and distribution of direct and indirect jobs supported by steel production in the United States. These jobs are at risk due to growth of excess steel production (and production capacity) in China, Korea, and other countries. Many other jobs (estimated below) have already been displaced by steel imports. Unfair trade in steel products has ignited another crisis in the steel industry which could result in further bankruptcies and reorganization or liquidation of U.S. steel capacity. No matter what becomes of U.S. steel production facilities, any major steel crisis is a direct threat to jobs supported by U.S. steel production, as was the case in the steel crisis of 1999–2003.

This analysis examines the direct effects of total steel industry output in 2012, based on data covering business establishments classified under the North American Industry Classification System (NAICS) and Bureau of Labor Statistics (BLS). The model evaluates jobs supported by total steel industry output from the two principal components of the steel industry: iron and steel mills (NAICS 3311)5, and steel products manufactured from purchased steel (NAICS 3312, and BLS industry 51). Data for real industry output was obtained from the BLS input-output matrix tables (BLS-EP 2014c).6

This analysis estimates the jobs supported directly and indirectly in the production of steel and steel products using an employment requirements table for 2012 (BLS-EP 2014b).7 Indirect jobs supported by steel production include input commodities such as minerals and ore, coke, coal and other fuels and electricity as well as services and other downstream resources consumed in the production and distribution of steel products. It does not include respending jobs supported by the wages of workers in the steel industry, or other industries supported by steel production.

B. Total jobs at risk

Table 3 shows that steel production supported 583,600 jobs in 2012. A total of 255,500 jobs supported were in manufacturing (43.8 percent of all jobs supported). The vast majority of manufacturing jobs supported were in durable goods industries (232,800; 39.9 percent). Other major sectors with substantial numbers of jobs supported included transportation and warehousing (52,100 jobs, 8.9 percent); minerals and ores (51,100 jobs, 8.8 percent); and administrative and support and waste management (56,000 jobs, 9.6 percent of jobs supported).

U.S. jobs supported by domestic steel production, by industry, 2012

| Industry | Jobs supported | Industry share of total jobs supported |

|---|---|---|

| Agriculture, forestry, fishing, and hunting | 1,100 | 0.2% |

| Mining | 55,100 | 9.4% |

| Oil and gas | 4,100 | 0.7% |

| Minerals and ores | 51,100 | 8.8% |

| Utilities | 9,400 | 1.6% |

| Construction | 8,900 | 1.5% |

| Manufacturing | 255,500 | 43.8% |

| Nondurable goods | 700 | 0.1% |

| Food | 300 | 0.1% |

| Beverage and tobacco products | 100 | 0.0% |

| Textile mills and textile product mills | 300 | 0.1% |

| Apparel | 0 | 0.0% |

| Leather and allied products | 0 | 0.0% |